At Nyca, we get excited about the explosive growth in the Office of the CFO space. As former CFOs, members of our investment team have experienced finance teams’ challenges firsthand and understand how innovative solutions can drive sustained growth. In this article, we share key insights from conversations with industry leaders, discuss major trends across the ecosystem, and put the spotlight on companies that are making a name for themselves in this expanding market.

Over the past few months, we’ve spoken with over 50 CFOs, CAOs, finance teams, and accountants. We learned about their day-to-day workflows, the tools and software apps they most depend on, and the biggest challenges that they face. The message that we have consistently heard is that CFOs today have more responsibilities than in the past. They also have access to far more granular data from disparate sources, which ought to improve the precision of financial reporting, but often remains difficult to reconcile. Through all of this, CFOs are drawing on a smaller labor pool to staff their teams. In what follows, we will discuss some of the major trends in the industry, key challenges that finance orgs have emphasized, and how entrepreneurs are responding to these opportunities.

Major trends

1. Expansion of the traditional CFO role

The modern CFO’s role has expanded far beyond its historical roots.

Core functions:

While a CFO’s core functions remain unchanged, CFOs and their teams interact and partner with many other systems and teams (e.g., product, sales, HR, legal, etc.). The CFO's tech stack now includes a wide array of solutions for data management, business intelligence, expense management, and more. Though CEOs continue to set a company’s strategic agenda, CFOs track, identify and manage non-financial goals, while also looking out for future opportunities and risks. In short, the modern CFO is as much a strategic business advisor as a financial leader.

2. AI is top of mind for many CFOs—but it is not a silver bullet

CFOs must determine the implications of Generative AI for the finance org. Many manual and time-intensive functions across the FP&A, treasury management, accounting, and AR/AP spaces have already been digitized. Generative AI, despite its many advantages, still stumbles with quantitative analysis, calculations, and hallucinations. CFOs are thus focusing on discrete applications of Generative AI, where accuracy and data privacy can be carefully managed, including data entry, anomaly detection, research summarization, report generation, reconciliation and streamlining audit processes.

3. A scarcity of accountants is driving technological adoption

94% of accounting firms experienced hiring challenges in 2023, which was largely a result of a double-digit decline in university accounting degrees. Furthermore, the upcoming retirement of a large percentage of the profession will exacerbate this scarcity. Stagnant pay and better job opportunities in alternative industries have also contributed to a wave of resignations, and more than 300,000 accountants have left the profession between 2019 and 2022. These capacity constraints have escalated as accounting firms are turning away clients or outsourcing work to keep up. The good news for startups is that the accounting labor shortage creates a tailwind for technology in the accounting industry. ~55% of smaller firms project new investments in AI and automation tools over the next 12 months, and the Big 4 are investing billions to develop internal platforms for document review, audit, employee software applications such as Finance, IT and Marketing.

The ever-expanding CFO Tech ecosystem

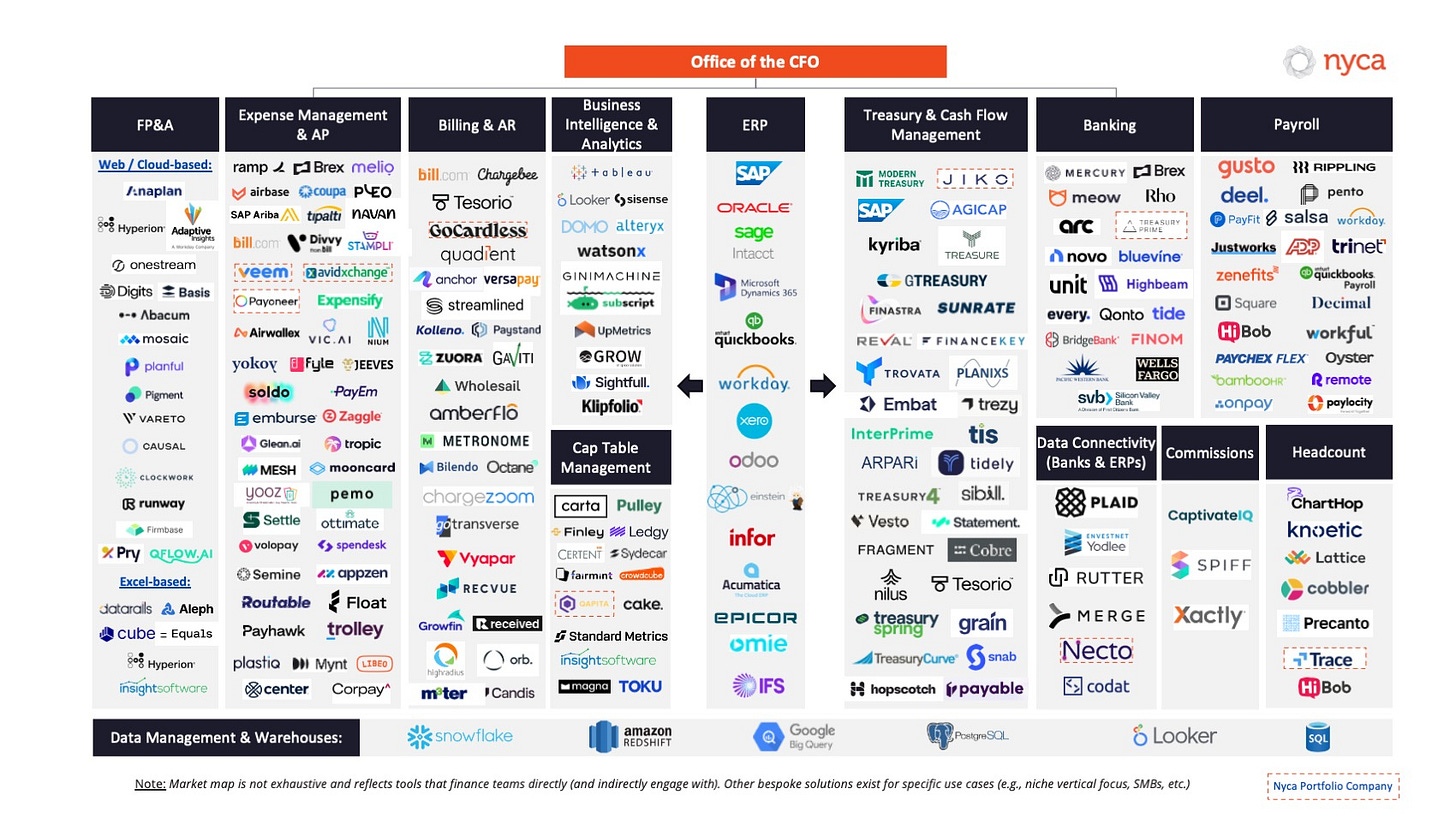

The number of companies and categories within the CFO tech landscape has exploded in recent years. Furthermore, the lines between categories are becoming increasingly blurred. Companies focused on one vertical have expanded offerings outside of their initial flagship solution, intensifying competition. This blending of categories in an increasingly crowded space reflects an effort to capture new market share or become a ‘one-size-fits-all’ platform for key customers. We highlight 200+ established, growth-stage, and early-stage companies below:

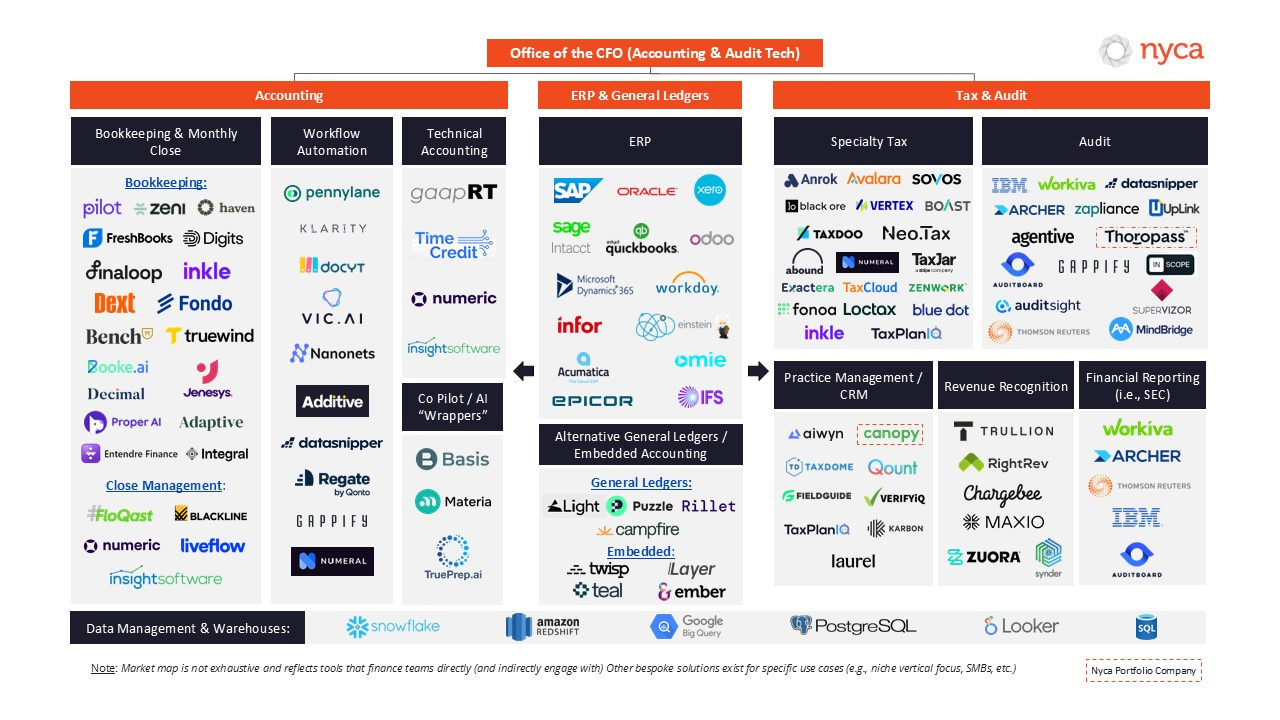

For accounting and audit tech specifically, players broadly fall into three buckets: accounting, ERP & general ledgers, and tax & audit:

CFOs’ challenges

We interviewed 50+ finance professionals from companies of all sizes, from early-stage startups to CFOs of some of the largest U.S. banks. Despite the abundance of tools available, many finance teams still face similar challenges as their predecessors did. Trailblazers such as Blackline, FloQast, Anaplan, OneStream, Ramp and Avidxchange have made significant strides in their respective accounting, FP&A, expense management, and AR/AP automation niches but several gaps remain.

Here are eight major challenges that finance teams consistently raised in our discussions:

Data quality challenges and growing need for a unified source of truth: As organizations grow in complexity, maintaining clean and consistent financial data across multiple systems becomes increasingly difficult. While these systems contain valuable financial data, they can be difficult to extract and often lack relevant finance controls such as audit trails. Teams also struggle to identify which system or version of data is the “truth,” leading to reporting discrepancies and lengthy reconciliation research.

“Garbage in, garbage out”: Disconnected accounting, planning and expense systems have a higher risk of errors between platforms and require time-intensive, manual data reconciliation efforts to verify accuracy of the simplest metrics. This inability to obtain timely and accurate financial data hampers real-time decision-making.

Challenges in managing global operations and multiple legal entities: Global expansion brings complexities in managing finances across legal entities, currencies, and regulatory regimes. To manage this complexity, companies typically rely on advanced ERPs. Yet, companies often struggle to maintain and get the most out of these systems due to continued drain on technical resources and required subject matter experts. These complexities continue to serve as a major competitive moat for monolithic ERPs like NetSuite, who despite their robust platforms, continue to miss the mark in addressing finance teams’ needs.

Enterprise and multinational cash management issues: Enterprise and multinational companies struggle to manage cash across multiple bank accounts and currencies, including forecasting and optimizing working capital.

Contract management processes for procurement & vendor relationships lack visibility and result in repeated overspending: Processes for tracking expenditures are inefficient, resulting in repeated overspending, missed cost-saving opportunities, and compliance risks. Complexities and variations across contracts and RFPs are difficult to track and standardize. New tools are needed to enable companies to better organize procurement processes and choose the most cost-efficient vendors.

Manual AP & AR processes persist with opportunity for further optimization: Many organizations still depend on manual processes for invoicing and cash collection, leading to delays and potential errors. Despite innovations in the spend management and billing space (e.g., Ramp, Airbase, Brex and Mercury as well as Chargebee, Stripe, Zuora, Avidxchange, and newer challengers like Hyperline) to alleviate these manual workflows, there is a continued interest in process automation and cash flow visibility solutions, tailored for specific verticals or company size.

New forecasting and scenario planning tools are needed but face an uphill battle against tried-and-true Excel: Legacy tools are either inadequate or slow to produce sophisticated, real-time and adjustable forecasting and scenario planning; they also are unoptimized for collaboration across team members. However, despite a need for tools that can handle complex business models or quickly model new scenarios, finance teams’ decades-old reliance on Excel limits willingness to adopt new tech.

Concerns about SaaS expenditures are rising, despite offering more tailored solutions than legacy ERP modules: While the rise of various verticalized SaaS tools provides more customized alternatives to expensive and slow ERP modules, many companies judge that the cost and effort of approving and onboarding multiple vendors outweighs their potential benefits. Moreover, some finance teams struggle to monitor subscriptions and manage renewals of these tools. Thus, for some teams, a single imperfect ERP is sometimes preferable to a more precise multi-tool solution.

Areas of opportunity:

The market opportunity for CFO tools remains substantial, however, the competitive landscape has become more saturated in recent years. This is especially true in the treasury & cash management, FP&A, and expense management space where newer players such as Necto, Modern Treasury, Mosaic, Planful, Ramp, and Brex, vie to capture incumbents’ market share. And despite the benefits that these companies offer, incumbents still maintain dominant market share.

We believe that next-generation CFO tech stack providers must rise to the challenge and offer differentiated, best-in-class wedge products. These solutions must have minimal integration requirements and seamlessly address customers’ needs through a tailored sub-vertical approach.

Companies such as Workiva, FloQast, Trullion, and LeaseCrunch are great examples of businesses that deliver a best-in-class initial product to drive customer stickiness and have since expanded into a comprehensive platform. Workiva made a name for itself with its simplified financial reporting product for enterprise and public companies. It has since evolved into a comprehensive platform covering audit, risk and ESG workflows with a $4.3B market cap. FloQast built an automated close-management accounting platform that competes head-to-head with the likes of Blackline and serves many notable mid-market and enterprise customers. Trullion and LeaseCrunch have successfully carved out their niche with mid-sized and enterprise clients in the accounting automation space with a specialized focus on lease accounting in addition to Trullion’s AI-enabled revenue recognition and audit tools.

Similarly to the companies above, this tailored approach should focus on delivering a wedge product, typically initially focused on a single industry vertical and size of customer (e.g., SMBs, large enterprises, etc.):

These are four areas that we are especially excited about:

Automation & Accelerated Close Management:

Controllers and accounting teams waste countless hours consolidating, identifying and reconciling information across a disparate set of data systems into manual excel sheets. ERP systems were built to record and store a company’s transaction data in a general ledger, not to seamlessly reconcile these transactions into consolidated financial statements. New AI-assisted tools can streamline time-intensive, manual workflows to speed up the close process and produce accurate, easily verifiable and auditable financial statements. These tools often enable automatic anomaly detection within finance data and fully auditable reconciliation workflows. Additionally, products with co-pilot functionalities will help finance professionals identify changes in financial statements and answer executive-level questions in hours vs. days of manual investigation. Companies such as FloQast, Numeric, Docyt and Truewind are all addressing challenges in this space.

Contracting and Vendor Management Tools:

Procurement teams struggle to effectively monitor, measure and evaluate existing vendor relationships. Variations and complexities across different vendor contracts are difficult to systematically track, despite standardization efforts, especially for large, multinational companies. Important clauses regarding automatic renewals or price increases are buried in lengthy contracts and often overlooked, resulting in repeated overspending as well as reduced bargaining power with current vendors. Improved contract recognition and vendor analytics tools that can optimize cost savings and streamline the RFP process will drive significant value to finance teams. To deliver a differentiated product, newer companies, or existing platform players such as Odoo, Ramp and Airbase must ensure that these tools also offer cost modeling and analytics capabilities and ensure that contract management tools can extract important sales, legal and operational information across a host of different platforms (e.g., ERPs, CRMs, HRMs, etc.).

Technical Accounting & Research Co-Pilot Tools:

Companies write technical accounting memos alongside their financial filings to justify the accounting treatment in 20+ technical subjects (e.g., revenue recognition, lease accounting, EPS, etc.). These memos are typically written by experienced accountants, either in-house or at outside accounting firms for a cost of $10-30k per memo. New purpose-built research tools could redefine memo drafting at a fraction of the cost, by combing through thousands of pages of accounting standards and automating 70%+ of memo drafting in minutes, with higher accuracy than general-purpose LLMs. Accountants could immediately focus their attention on the highest value topics that require careful judgment and years of expertise.

Players such as TimeCredit and GaapRT are working to redefine the technical memo drafting process as their initial wedge solution. Other companies, such as Materia, Basis and TruePrep.ai offer co-pilot research tools that can be used to write technical accounting memos and AI-enabled tax assistant products that expand beyond technical accounting memos.

Rethinking the Legacy ERP:

Legacy ERP solutions such as NetSuite and SAP have established an enduring competitive moat as the system of record for many large companies. However, they have failed to keep pace with the technological and financial needs of their customers, with businesses increasingly opting for best-in-class point solutions to complement legacy ERPs’ general ledger capabilities. Astronomical implementation costs and high tech resource budgets may be the norm for large enterprise customers but no longer make sense for tech-forward, high growth companies who are earlier in their journey and require more nimble, tailored solutions. Despite the strong grip of legacy players today, innovation and new blood in the ERP market is desperately needed, especially for mid-market companies. We’re excited to see new general ledger solutions such as Light and Rillet as well as embedded accounting platforms such as Layer, Teal, and Twisp.

Where do we go from here?

The next generation of financial technology has the potential to massively improve efficiency. AI and automation will change how businesses make financial decisions and manage their resources. We expect to see continued innovation across the entire CFO tech stack, from core accounting and FP&A functions to more specialized areas like treasury management, regulatory compliance, and technical accounting & research. If you’re an entrepreneur building in any of these areas, please reach out; we’d love to chat!