There is a paradigm shift happening in crypto. The days of speculation and money laundering are coming to an end, and stablecoin use cases are rapidly taking over.

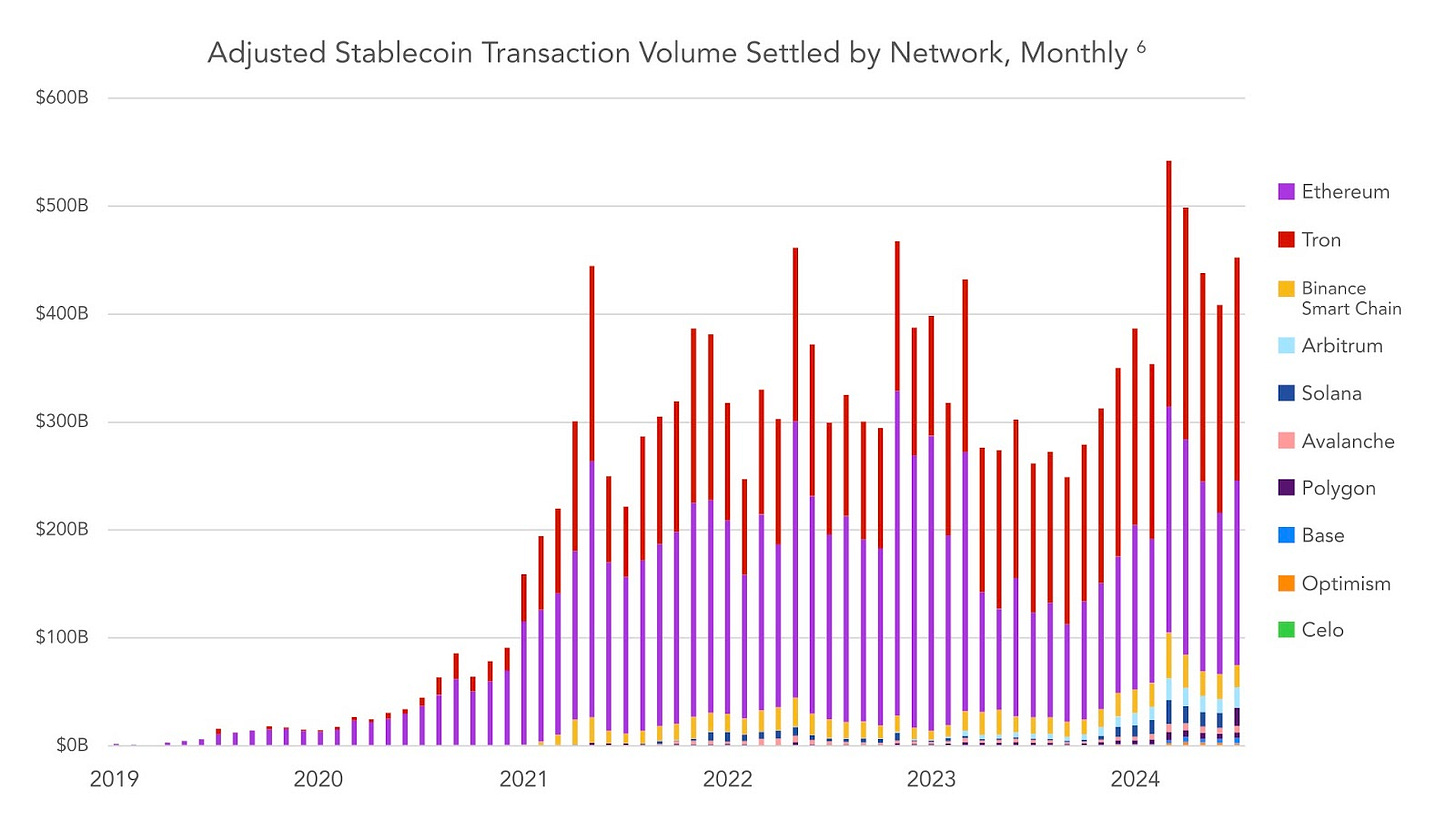

Per a September 2024 report from Castle Island, Brevan Howard, and Visa (here), an estimated $5.3tn of transaction volume is estimated to settle via stablecoins this year, up from $3.7tn last year:

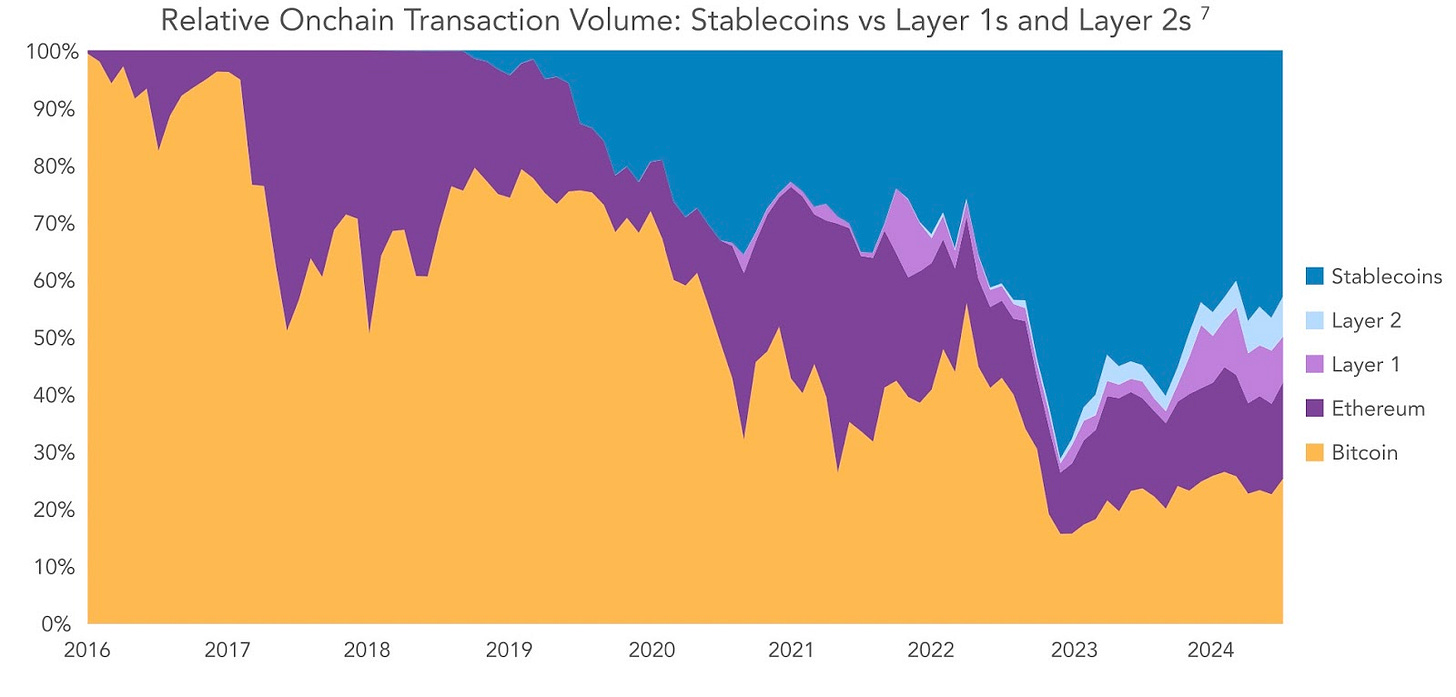

And Stablecoins are rapidly gaining share from other crypto assets (~50% of settled volume on public blockchains today):

This rapid growth is enough to justify an investment in the space. The dollar, in all its forms, is the most popular product in the world. But beyond serving as a safe-harbor currency for those in unstable geographies, stablecoins have the potential to unlock true real-time payments in the U.S. and abroad. Tom and our former colleague, Izzi, wrote a thorough paper last November (see here) outlining the problems with today’s account-to-account (A2A) payment architecture and how recent changes to the Uniform Commercial Code (UCC) allow for a more “direct, efficient, and real-time” payment architecture underpinned by controllable payment intangibles (CPIs) / Electronic Money Tokens (EMTs). Before diving in, we recommend everyone take a brief read through the piece from last year to better understand where we are today.

Below we seek to build on the paper’s conclusions to frame the potential “value chain” for the EMT / Stablecoin space.

Classic Payment Value Chain - C2B Card Payments

Most people are familiar with the value chain in C2B (consumer-to-business) card payments today and how card networks, acquirers, processors, and (optionally) PayFacs interact to move money from consumers to merchants.

In the payment card world, networks capture a significant share of the value. Once a consumer has elected (knowingly or not) to use a particular network to make a payment to a merchant, there is only one path available to complete the transaction—the network chosen by the consumer.

EMT Value Chain

We see a similar value chain in the emerging EMT world, though it is less obvious where the value will accrue.

For simplicity, we have focused on the value chain that links a given ledger to a given user. In theory, the value at the ledger level should be interchangeable—every dollar is, by definition, the same as any other—so the value should come to rest elsewhere. To see where, let’s take a trip through each component of this value chain.

Collateral Custodians

Collateral custodians are financial institutions that securely hold USD collateral (e.g., T-bills) that is exchanged (and in future, redeemable) for Stablecoins / EMTs. Examples of collateral custodians include Fidelity, Bitgo, Blackrock, and SVB.

EMT Sponsor

EMT Sponsors enable collateral custodians to change public blockchains (“L1s”: BTC, ETH, etc.) and proactively reconcile these changes with what custodians have reflected internally.1 Circle (USDC) and Tether (USDT) are two examples. Successfully handling real-time data changes and money movement between all of the important L1s requires sophisticated technology infrastructure that custodians do not have the expertise to build in-house. It is easier for custodians to work with Circle and instantly gain access to 17+ L1s. Today, EMT Sponsors are regulated under MiCA in Europe and at the state level in NY and CA.

Exchange

These are the businesses that most are familiar with in the crypto space (Coinbase, Gemini, FTX, Binance, and Zero Hash). They enable the exchange of digital assets, including stablecoins, at scale. As the headlines over the last two years have proven, this business is not without its challenges in terms of regulatory compliance and stability.

Wallet

Crypto wallets enable users to store, manage, and interact with cryptocurrencies and blockchain-based assets. They are essential for both retail and institutional investors, as they provide secure and often user-friendly interfaces for accessing crypto holdings. Wallets differ on a couple of dimensions.

The one most familiar to traders is the hot/cold distinction. Hot wallets are connected to the internet and facilitate easier access for transactions. Cold wallets by contrast are offline and provide enhanced security for long-term storage. Popular hot wallets include MetaMask and Trust Wallet, which are known for their ease of integration with decentralized applications. In contrast, cold wallets like Ledger and Trezor offer hardware-based solutions that safeguard private keys from online threats, appealing to users prioritizing security.

Wallets also vary in terms of who controls the keys associated with the wallet. This distinction is generally captured with the terms “custodial” and “self-custody.” Most traditional crypto exchanges offer custodial solutions for their customers. With a custodial wallet, the provider manages the keys associated with a wallet, and when a user seeks to use the wallet, they provide instructions to the service provider in much the same way they would with a traditional financial institution. With self-custody solutions, however, the user controls the keys associated with the wallet address and interacts directly with the relevant ledger.

Who will win and where will value accrue?

In our view, the value in this chain will likely accrue in several places. Some of the winners will be determined by the regulatory framework. Where the relevant regulatory framework requires a party to obtain a license in order to provide a given service, there will almost certainly be a limit on the number of providers. Technology will play an important role in determining winners among the licensed providers—e.g., an EMT capable of supporting a given asset across more protocols is likely to capture more business than one with fewer integrations. But if regulation significantly limits the number of providers, all may capture significant value. At present, the U.S., EU, and many other jurisdictions require collateral custodians, EMT sponsors, and exchanges to obtain licenses in order to operate.

The regulatory framework for the wallet layer is less proscriptive and less clear. In general, custodial solutions are both regulated and licensed. Non-custodial solutions, however, are currently unlicensed. If this distinction holds, we see an opportunity for the best technology to prevail among self-custody providers. This includes the core MPC layer that enables self-custody wallets to function with the features that most commercial users expect of core value exchange technologies (e.g., avoid the Russ Hanneman problem). Now, “best” may be very context specific—e.g., if the primary users are high-frequency traders, the best technology will optimize for speed and reliability of transaction execution. But the playing field should be more open.

The Big Open Question (at least in the U.S.): Regulation

The regulatory framework will shape the competitive playing field for competitors in the EMT value chain. As this recent piece in Forbes explains, the details of that framework remain up in the air. But that is true of many verticals in the financial services industry, including card based payments. Twenty years ago, the card networks were forced to unbundle acceptance of debit and credit cards. A few years after that they had to grapple with regulation of debit interchange and the imposition of rules requiring debit cards to carry the marks of multiple networks. The card networks adapted. Firms in the EMT space will adapt as well.

In general, we expect the U.S. to follow the path taken by the E.U. with Mica, with one distinctly U.S. twist. Where the EU has created a passporting regime that allows an entity licensed in one country to offer EMT services across the community, we expect the U.S. to create a regime that regulates EMT providers at either the state or Federal level. We hope that state licensed providers will be able to operate on a level playing field across the U.S. with only one license, but it is possible that state licensed providers will face a Balkanized regime similar to the one that governs money transmission.

The Future of Payments

Digital assets have been the source of controversy and attention for more than a decade. But setting aside all the debates about the lasting value of Bitcoin, ether, and other crypto currencies, they have changed the future of payments by showing that people will use a native digital alternative to the dollar and other currencies. Although the predominant use of electronic money tokens to date has been the facilitation of trading of other digital assets, we see nascent evidence of real commercial use in services such as Fence.finance, which uses EMTs to settle obligations in real time between debt funds and asset backed lenders. We believe that many firms in the U.S. and EU, possibly even a majority of firms, will make payments to at least one commercial counterparty using an EMT within the decade. Shifts in payment behavior of that magnitude are once in a generation rare. Given the size of commercial payment flows, we see opportunities up and down the value chain to build massive businesses.

By "changing" a public Blockchain, we refer to an EMT Sponsor issuing or deprecating an EMT to reflect changes in volume. Basically, EMT sponsors do for L1s what money market sponsors do for holders of shares of money market funds. They ensure that the amount of tokens available reflects the underlying balances. Circle has a simple explanation on its site explaining what “minting” and “burning” mean.