At Nyca, we get very excited about credit. Extension of credit and the magic of leverage helped catapult the American economy to be the largest in the world, and the U.S. system has been quite effective for decades. However, like many areas of financial services, credit is undergoing a disruptive period. The availability of new and diverse data coupled with evolving modeling techniques and new forms of distribution have opened up an exciting new era. Before we dive into the future of credit, it’s important to define the state of the market today. Why are we seeing cracks in the system, and what is contributing to the problem?

The following is our first installment of a three-part credit-focused series to be released over the coming weeks: “Fooling FICO, Contextual Credit, and a Call for a Better Bureau”

One of the biggest successes in fintech’s brief history is Credit Karma. Its business model is relatively simple: attract consumers through a real (and free) value proposition of improving one’s credit. Monetization of such a service is brilliant. Selling consumer leads to lenders is a win/win. Customers are offered better financial products (lower fees and/or rates) versus what they have today. Lenders, in turn, are able to prequalify individuals through review of the credit profile or demonstration of good behavior.

So, what’s the catch? Not much, unless we take a step back and analyze what a material change Credit Karma catalyzed in consumer credit scoring. To be clear, Credit Karma didn’t change credit scoring. However, CK was arguably the first mass-consumer product to allow individuals a look under the hood of how their FICO score was determined and what tactical steps were necessary to improve their credit rating.

We believe that “the Credit Karma effect” has been a net positive for the U.S. consumer credit system. It turns out that consumers who view their credit reports tend to make fewer late payments and are less likely to enter delinquency. However, we worry that recent “innovations” in some corners of the credit scoring ecosystem may have less salutary effects. Some new data sources being furnished to credit bureaus lack a home within the bureaus and could even end up degrading FICO’s usefulness. For fintech entrepreneurs considering how to innovate in consumer underwriting, we think it’s important to understand how the current credit reporting system works, what new ideas might fit well within that system, and when it makes more sense to bypass the current system altogether.

What’s in a FICO score?

Before we discuss new developments in credit scoring, it’s helpful to review some history. As the CFPB summarizes in an excellent report, the first U.S. credit bureaus appeared in the 19th century to help local merchants determine which customers were creditworthy. At the time, a credit bureau’s job was straightforward: maintain a list of individuals who were delinquent on debts, so that merchants knew not to lend to these individuals. Over time, as the provision of credit shifted from local to national banks and credit cards became more common, local credit bureaus gave way to National Credit Reporting Agencies (NCRAs). Today, three NCRAs (Equifax, Experian, and Transunion) are the primary sources of data on consumers’ credit histories.

Beginning in 1990, the Fair Isaac Corporation—today known simply as FICO—began using data from the NCRAs to produce a score meant to predict the likelihood of delinquency. Specifically, the FICO score is meant to predict the likelihood of 90-day delinquency within two years of a consumer taking out a new loan. While credit scores other than FICO exist (e.g., the VantageScore, produced by the credit bureaus themselves), the FICO score remains the most widely used. In fact, FICO produces numerous versions of its credit score, including some aimed at specific industries (e.g., auto lending) or incorporating distinct data sources.

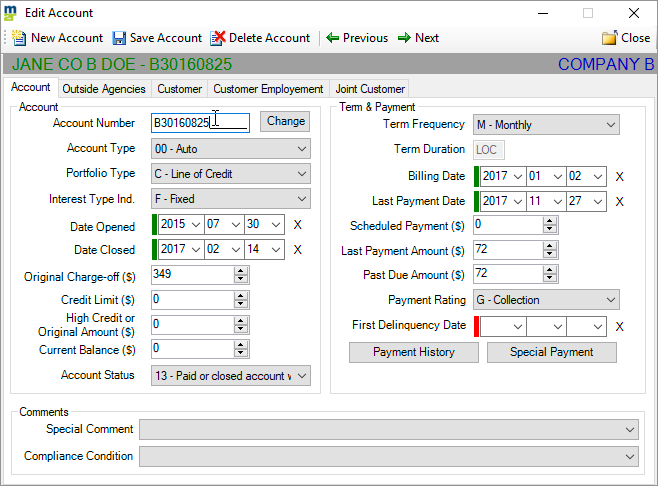

The diagram above summarizes how the major puzzle pieces of the credit scoring ecosystem fit together. Furnishers (typically lenders) “furnish” data to the credit bureaus. The furnished data is essentially a list of all the loan/credit accounts that the lender holds, with information on the borrower, outstanding balance, repayments and late payments, and other details for each account (or “tradeline” in credit score parlance). In total, there are more than 10,000 furnishers, though just 10 of these furnishers account for 57% of all tradelines. Data is typically furnished to the bureaus on a monthly basis. Bureaus then consolidate the data to produce a single credit file for each consumer within their data universe (or, more commonly, for all consumers who have at least 6 months of credit history), and then sell these credit files to FICO to compute FICO scores. While the FICO scoring algorithm is proprietary, it is influenced by several factors (payment history, balances owed, credit mix, new credit, length of history, etc.), and ultimately both the FICO score and the underlying credit files are sold to lenders to incorporate in underwriting models.

Furnishing mechanics

Rules around furnishing govern the entry of all new data into the credit reporting ecosystem. At a technical level, data is passed from furnishers to the credit bureaus in the Metro2 format, a schema for reporting tradelines. Data is typically reported monthly and includes dozens of fields (e.g., customer name, customer address, credit limit [if applicable], current balance, account status, etc.). Two fields in the Metro2 schema are especially important for our purposes:

Portfolio type defines the general category of the credit product. There are only five possible values for portfolio type under Metro2: line of credit, installment, mortgage, revolving, and open (a credit product where the entire balance is due in one payment).

Account type defines the specific type of tradeline being reported. There are more than 60 possible account types under the Metro2 system, ranging from the general (medical debt, education) to the highly specific (USDA real estate mortgage loan, timeshare loan). Notably, “credit card” and “secured credit card” are each a distinct account type. Utility payments and rental payments are also options within the universe of account types.

Sample trade line submission in Metro 2 format

Image source: m2reporter

The complexity of the furnishing process—dozens of fields to fill in, with a wide range of possible values for some of them—means that furnishers occasionally must make judgment calls. If a credit product does not cleanly align with one of the account types that Metro2 provides, the furnisher must pick the best fit. Furnishers also face strict regulations under the Fair Credit Reporting Act, which requires furnishers to promptly correct any errors in reported information and to investigate any consumer disputes, among many other rules. Indeed, furnishing is sufficiently complex that fintech Array1 has an entire business line helping companies to correctly furnish data.

In what is meant to be a symbiotic relationship between lenders, credit bureaus, and FICO, the furnishing process is where many challenges arise. A non-exhaustive list of potential problems includes:

Corrupted/incorrectly entered data: suppose an auto loan is accidentally entered as a personal loan, or a consumer’s successful monthly payment is erroneously recorded as late. Either of these errors will cause the credit file to be partly incorrect, which means that (1) the computed FICO score will likely be inaccurate and (2) the credit file reported to the lender will also be inaccurate. Because the lender might use a combination of FICO scores and variables that it derives from the credit file, inaccurate credit bureau data can have a doubly bad impact on underwriting decisions. Hyundai’s US auto finance arm was fined $19.2mm in June 2022 for “repeatedly providing inaccurate information to nationwide credit reporting companies and failing to take proper measures to address inaccurate information once it was identified.”

Consumer identification or matching errors: credit bureaus must correctly match the billions of credit line datapoints that they receive each month to consumers. If two credit lines that belong to the same consumer are not both matched with that consumer, then the consumer will end up with an incomplete credit report.

Synthetic identity fraud: credit products issued to individuals with fabricated (or “synthetic”) identities are estimated to cost financial institutions $2bn per year in fraud losses. Crime rings piece together names, social security numbers, and other identifying information to create entirely synthetic identities, while some individuals with tarnished credit histories manipulate their own identities to start building credit anew. Synthetic identity fraud is a big enough topic to fill an entire article—and indeed, fintech startup SentiLink2 has built a business helping financial institutions detect identity fraud.

Furnisher fraud: new furnishers apply to furnish data to the credit bureaus. Although the bureaus attempt to verify that furnishers are real businesses reporting accurate data, with more than 10,000 furnishers there will inevitably be some fraud. “Furnisher fraud” might take the form of reporting fake credit lines to help consumers boost their credit scores. Furnisher fraud is rare, partly because perpetrators can face criminal liability, but it does occur.

Spurious scores?

Our discussion so far might seem to imply that the credit reporting and underwriting system functions nearly seamlessly. In fact, we think that there is ample room for improvement. The historical beef with FICO is that it does a poor job analyzing risk of lower credit borrowers. Specifically, near prime and subprime borrowers are very challenging to score with FICO’s methodology due to thin files and potential adverse events (medical bills, unemployment). Our Capital One friends have taught us that borrowers with scores from 620-660 are called “movers”, meaning the borrower is either becoming more or less creditworthy. The best lenders know how to identify good risk in the movers segment and avoid the falling knives. This is what makes Capital One the most successful subprime lender in the US in terms of scale.

Many fintech entrepreneurs have followed the Capital One path and built companies that use alternative data, more sophisticated modeling techniques, and other strategies to support lending to customers whose creditworthiness is not fully reflected in FICO scores, or who have no credit files at all. Other founders have taken a different approach: if credit access is based on FICO, then it must be possible to develop methods or create financial products that accelerate a consumer’s ability to achieve a better score. And if FICO scores are predominantly based on credit the consumer could not attain, why not “create credit” and convince the credit bureaus/FICO that the offering was analogous to mainstream products?

The latter approach worries us. If it is possible to improve consumers’ FICO scores without commensurately increasing their likelihood of future loan repayment, then the FICO score will become a weaker measure of creditworthiness. Some examples of “FICO spoofing”:

We’ve observed some fintechs offering consumers a “credit card” for low fixed monthly expenses (e.g., monthly subscription payments). The card is used to directly pay the services monthly and is only authorized for the approved charges. With each credit charge, a simultaneous sweep of funds from the consumer’s checking account essentially de-risks the transaction, effectively acting as a debit card. In some cases, the credit limit reported to credit bureaus is an annualized version of the monthly expenses (i.e., twelve times the monthly expenses charged to the card), so the utilization rate reported to the credit bureaus is at most 8.3%. Furnishing this tradeline to the credit bureaus as a credit card seems disingenuous at best.

Credit builder loans (CBLs) are “loans” in which the order of payments between lender and borrower is inverted. In a standard personal loan, the lender sends the borrower, say, $1,000, and the borrower repays the $1,000 (plus interest) in a series of installments. In contrast, under a CBL, a lender deposits the $1,000 in (essentially) an escrow account, and the $1,000 only becomes available to the borrower after she has repaid the $1,000 + fees to the lender. Thus, a CBL is not really a loan, at least in economic terms. Nevertheless, because CBLs are reported to credit bureaus as personal loans (CBL is not an “account type” in metro2), they can be useful instruments for boosting a consumer’s FICO score.

Ironically, Experian is one of—if not the largest—actor in the credit enhancement space through Experian Boost. There are a few aspects that are interesting about this offering. First, the product is aimed solely at FICO 8, the dominant score despite recently celebrating its Bar Mitzvah (13 years old!). Second, the items Experian offers to furnish, namely utilities and rent, are not factored into FICO 8, meaning that Boost functions more as a data collection exercise. Third, from the small print, it is not clear that Experian is sharing this newly furnished data with Equifax or TransUnion, meaning credit data is becoming more asymmetric rather than the historical precedent of conforming data sets.

Our gripe with “instant-sweep credit cards” and CBLs is not that they are inherently useless. To the contrary, CBLs might be useful as savings devices3, and both of these products might provide some useful predictive signal on creditworthiness.4 Yet reporting these products to credit bureaus as credit cards and personal loans is akin to fitting “square pegs into round holes,” as our friend Kevin Moss wrote recently in an excellent piece with Alex Johnson.

That mislabeled credit products might undermine FICO is more than a mere supposition. One piece of evidence comes from a group of economists who ran a randomized trial of granting consumers access to CBLs. In a 2019 study, they found evidence that CBLs may cause FICO to become less predictive of future delinquency, though a consumer’s choice to get a CBL may itself be a positive signal for creditworthiness.5 We’ve heard similar concerns from some lenders who are adjusting their models to exclude data from certain furnishers whose credit builder tradelines (reported as personal loans or credit cards) have distorted their models’ scoring of customers.

The history of medical debt and FICO offers an older version of this same tale. Medical collections debt has historically been lumped together with non-medical collections debt in credit scoring models. Yet research suggests that outstanding medical collections are less predictive of future delinquency than outstanding non-medical collections, so lumping these two variables together obscures an important nuance that credit scores ought to detect. In response to this problem, FICO’s next version of a score (FICO 9) treats medical debt distinct from other credit categories.

The upshot of all this history is not that CBLs should cease to exist, nor necessarily that medical debt should be cut altogether from credit scoring algorithms. Instead, these examples illustrate how data that is conceivably useful for underwriting can be counterproductive when forced into established credit scoring models.

Enhancement or erosion?

While the erosion of FICO due to misinterpreted or misleading data is one reason for concern, another concern is that useful data that ought to be incorporated into credit decisioning is left out. Research as far back as 2007 has shown that some combination of debit card data, utility bill payments, bankruptcy records, and other data sources that are largely excluded from traditional FICO scores can predict delinquency just as accurately as FICO. Fintech companies like Upstart, which use employment and education data to underwrite consumers with thin or no credit files have also produced evidence that—much like Capital One—their models distinguish good from bad credit risk better than FICO at the low-end of the FICO range.

The more recent FICO score versions (9 and 10) and VantageScore incorporate forms of “alternative data”, potentially including rental, utility, and other potentially predictive data points. However, most lenders still use FICO 8 (released in 2009) in their models, and it can take years for a lender to update their model to utilize a new version of FICO. Other forms of alternative data, such as BNPL Pay-in-4 data face a similar barrier to being included in FICO-based underwriting processes.

With FICO enhancement a gradual process at best, we expect that the best new ideas in consumer lending will originate outside the FICO and credit scoring ecosystem. We are enthusiastic about many opportunities that fintech entrepreneurs are pursuing to bring new data to underwriting and help overlooked segments of the population access credit—and in each case, we think the idea is much bigger than a single credit score. With that in mind, we offer three pieces of advice to fintech entrepreneurs in the credit space and the lenders collaborating with them:

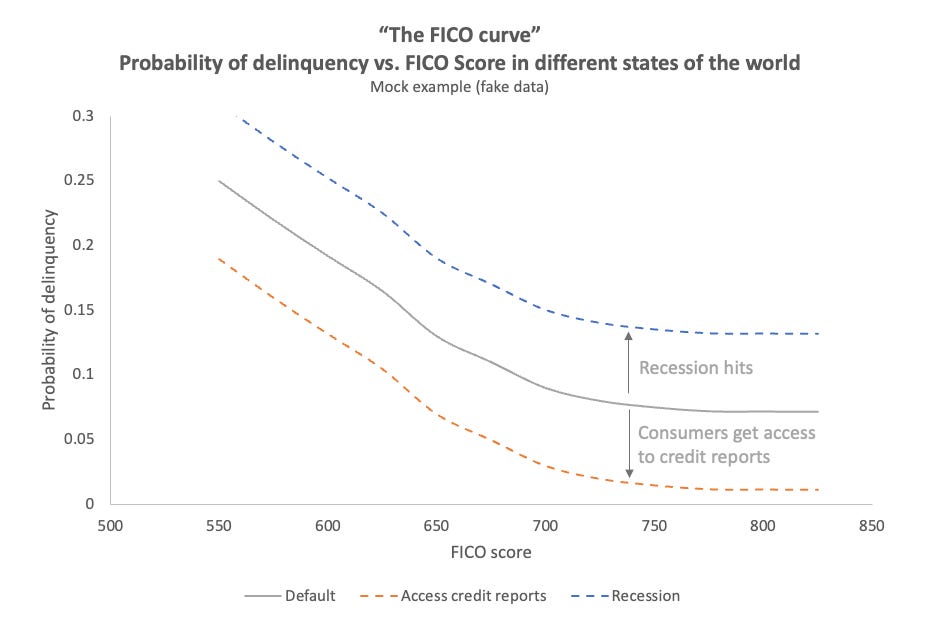

Novel consumer credit tools must either shift the FICO curve or add new underwriting signals. Tools like Credit Karma have been useful in part because showing consumers their credit reports increases their likelihood of making loan repayments on time. Though we can’t necessarily identify the mechanism through which Credit Karma changes consumer repayment behavior (does CK provide a nudge, financial education, or something else?), there is compelling evidence that showing consumers their credit scores reduces delinquency. We like to think of granting consumers access to their credit scores as “shifting the FICO curve”; that is, if you plot a curve of probability of delinquency vs. FICO, consumer access to credit reports shifts the entire curve because the probability of delinquency is lower across the range of FICO scores. Recessions have a similar effect, in the opposite direction. A second approach is to add new variables to underwriting models altogether. This is the thesis underlying cashflow-based underwriting: at any FICO score, likelihood of repayment can be predicted more precisely by incorporating bank account data on income and expense flows. To be clear, distinguishing these two approaches to improving underwriting is not a new idea. However, we think they are a useful juxtaposition against a third approach that we identified earlier: trying to fit fundamentally new types of data into already-established scoring techniques. To be blunt, innovating within the FICO paradigm seems like the wrong approach.

Underwriting innovators usually need to eat their own cooking and must constantly adjust the recipe: Many entrepreneurs believe that they can build a better credit scoring algorithm than FICO, at least for a specific group of borrowers. As we mentioned in an earlier blog post on BNPL, building a better FICO was the original idea behind Affirm. Yet as Affirm discovered, the most common retort to a company that claims to have a better underwriting algorithm is, “Then why don’t you lend money?” Just as chefs must taste their own dishes, businesses with novel underwriting techniques need to bear the risk of their own algorithms. These businesses also must constantly adjust their recipes; the best teams in underwriting reevaluate and improve their models continuously to respond to changes in the macro environment, signal degradation, competition, and so on.

The next wave of credit innovation will be contextual: We believe the most promising opportunities in credit will incorporate contextual data into the underwriting process. It’s only a matter of time before cashflow data is standard in all consumer underwriting; for digital lenders, app-specific data will also be useful, and secured loans might be able to incorporate data about borrowers’ interactions with their products to better price risk. Rather than trying to create a “one-size-fits-all” solution, the future of underwriting will be increasingly context-specific.

Our next installment of this series will dive into what we mean by contextual credit and why we view its adoption as a material shift in the way credit risk is assessed for consumers and SMBs.

Array is a Nyca portfolio company.

SentiLink is also a Nyca portfolio company.

Why might a CBL be useful as a forced savings mechanism? A $200 CBL effectively guarantees that the consumer will have $200 at the end of the loan period; the consumer pays $200 + fees to the lender, and the lender subsequently gives the consumer access to $200. For someone who otherwise might spend the $200 during the course of the loan period, the CBL can help encourage savings. This savings mechanism often comes at a steep price, however (e.g., if you pay the CBL lender $210 including fees and only get back $200 at the end of the month, this is a 60% APR).

We should also point out that many fintechs that offer these sorts of credit-builder products also offer other products that are unquestionably useful to consumers, such as lower-cost bank accounts, budgeting tools, and financial advice.

Specifically, the study finds that FICO becomes less predictive of future delinquency among consumers who have significant installment loan activity on their credit reports prior to the CBL study. This finding is not statistically significant, largely due to a small sample size in the relevant subsample, but the researchers speculate that the result might be economically meaningful in magnitude if it could be studied with more precision.

This statement is inaccurate: "Bureaus then consolidate the data to produce a single credit file for each consumer within their data universe (or, more commonly, for all consumers who have at least 6 months of credit history), and then sell these credit files to FICO to compute FICO scores. "

The bureaus don't sell credit reports for FICO to score. The bureaus license the scoring model(s) from FICO to create the scores that are delivered with each report.